General News Blog

My WordPress Blog

My WordPress Blog

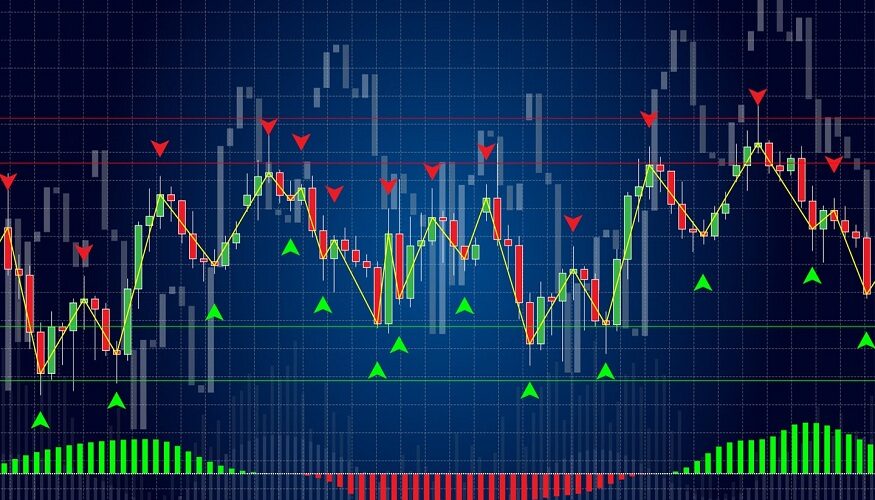

The most important aspect of technical analysis has always been support and resistance. It is utilized by the vast majority of market participants, ranging from large banks and trading businesses to small retail dealers. It’s also the most fundamental technical analysis pattern for determining where supply and demand collide. Essentially, it refers to the price levels on just a chart that prohibits the price from being pushed in a particular direction. Understanding how to use support and resistance can help you spot possible short and long trading opportunities.

The support and resistance indicator for Meta Trader can calculate support and resistance levels and plot them on the chart. The MT4 and MT5 (S&R) Lines indicator is a strong indicator that can locate and display levels of support and resistance. In this session, we will show you how to save time by drawing (S&R) indicator lines on the MT5 & MT4 charts using the best indicators.

You may use the Support and Resistance Lines indicator to: Find better chances – understanding where support and resistance are located allows you to change your strategy.

Allow the indicator to compute the level and display it on the chart to save time.

Receive alerts when the price approaches or passes through a level of support or resistance.

The price tends to swing between support and resistance levels. They are the type of pricing barriers that are difficult to overcome. The human eye can quickly distinguish both support and resistance. You should pay attention to the near prices and watch where they consolidate or rebound. It is a different scenario when it comes to mathematically calculate these levels. To determine these levels, a complex algorithm should be used. The indicator looks at a series of candles to see where the price is bouncing or staying the same. The median price is then calculated, and a horizontal line is drawn on the display.

A level of support is one where demand is deemed to be strong enough to keep the price from falling further. Buyers will try to purchase more, and sellers will be less willing to sell when the price of a security decreases and becomes cheaper, establishing a support line.

Resistance, on the other hand, gives possible trade entry opportunities for short trades or exit positions for long trades. The term “resistance” refers to a price level that is typically strong enough to stop the price from increasing. As security’s price approaches resistance, sellers will be more likely to sell, and buyers will be less likely to purchase.

The following characteristics can be found in the Support and Resistance Lines indicator for MetaTrader

You may establish a trading account using any MT4 Forex traders like roboforex login or any other MT4 trader to use the indicator for MT4 that is offered there. However, if you wish to utilize an MT5 version of the indicator offered here, you will need to sign up for a Meta Trader 5 account with a broker.

If you are a day trader who relies on support and resistance to assist you to locate profitable entrances and exits, the price interval duration should be brief, such as 15 to 1 minute. Use price charts based on hourly, daily, weekly, or monthly interval intervals if you are a long-term trader. It is critical to note that you should select a chart based on price intervals that correspond to your trading approach.

The following approaches can be used to trade support and resistance:

Support and Resistance (S&R) Bounce

The purpose of this method is to catch the rebound, as the name implies.

This method informs you if the price does not break through the support or resistance levels. Many traders make the mistake of placing their orders on support and resistance levels immediately. When employing the bounce, you want to increase your chances of success by confirming a hold on support or resistance. For example, rather than purchasing right away, you might want to wait for a bounce before entering. Before entering a short position, wait for it to bounce off a level of resistance.

The Easy way: Wait for a price drop to the (S&R) levels and enter when the price rebounds instead of entering on the break.

The Hard way: When the price goes through the zone, the best method to play breakouts is to buy or sell. By just entering (S&R) breaches when they initially occur, you run a high danger of getting entered into fake breaks.

Before starting or quitting a trade, the (S&R) Lines indicator may be used to assess specific criteria. We all utilize different tactics throughout our trading operations, but support and resistance are virtually always present in every trader’s toolbox.

The S&R Lines indication may be used to: